Grey Power Federation hold strong positions and recommendations for the future direction of NZ Super Benefits. Read our summaries below, and click through for a more in-depth analysis.

GPF is committed to all New Zealanders, with appropriate residency qualifications, remaining eligible to receive a universal NZS income from the age of entitlement.

GPF refutes media and political scaremongering that NZS is unsustainable and needs to be urgently overhauled

(add image to this section)

GPF is committed to eligibility for NZS to be maintained at age 65, despite some political parties recommending an increase to 67 years of age.

GPF is committed to supporting ongoing benchmarking the NZS after tax payments to a minimum % of the median national wage after tax (currently 66% for a couple), with adjustments for CPI increases where these exceed any increase in the median national wage increase.

GPF are committed to resisting any attempt to make NZS means tested.

GPF is aware of a significant group of retirees struggling to survive on NZS at its current levels.

GPF supports the ongoing government and employer subsidisation of individual contributary savings accounts under the KiwiSaver scheme to enable future generations to have greater financial resilience when entering retirement.

To provide security for future retirees the guarantee of this provision in retirement provides a level of security and hope that is much needed in an increasingly unpredictable world. It allows those preparing for their future retirement to know what financial and accommodation goals they wish to achieve prior to retirement.

GPF was supportive of the recent legislation {NZS & Retirement Income (Fair Residency) Amendment Act 2021}, aimed at gradually increasing the threshold of residency from 10 years to 20 years to improve the sustainability of NZS in its current settings. as well as encouraging those wanting to retire in NZ to have made greater provision for their retirement should they retire after having resided in NZ for less than 20 years.

With one of the most efficient pension schemes internationally tinkering with settings on universality will only add to the costs of administration.

NZS is one of the most efficient national pension systems worldwide, a gross cost of 5% of GDP in 2020/21. In 2060/61 Treasury estimates that its cost will rise to a gross cost of 7.7% of GDP. 7

These figures need to be seen in context of other OECD countries where the average gross cost was 7.7% in 2017. (NZ was 4.9% in 2017). However, as NZS is taxed, as are additional earnings above NZS, the nett cost for NZS in 2017 was only 4.2%. (Average nett cost in 2017 in the OECD was 7.1%).10

The other significant caution is in the accuracy of forecasts on NZS expenditure compared to GDP from Treasury. Budget 2000 projected that NZS would be 7% of GDP by 2021, and 11.5% by 2060.

While it is evident that the cost of NZS as a % of GDP will rise over the next 30-40 years it is still affordable and excellent value compared to many others worldwide. Any proposed changes need to be carefully evaluated and consulted upon prior to implementation well into the future.

The 2022 Review of Retirement Income Policies from the Retirement Commissioner recommended that “To provide good retirement outcomes for all: Maintain NZ Super settings (current age of eligibility, universal, indexed)”. (Read full Review)

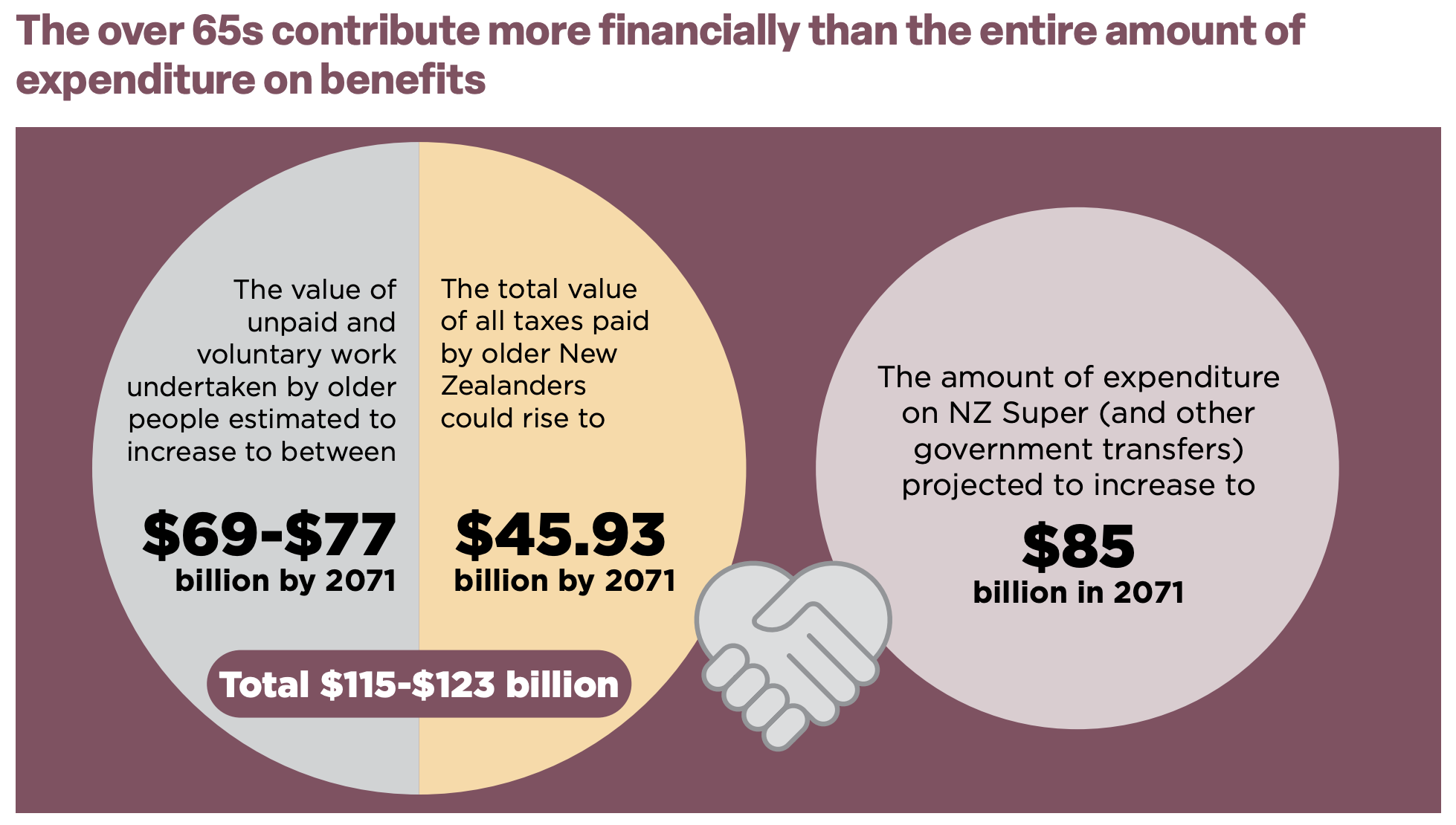

The Retirement Commissioner has refuted the concept that NZS is unaffordable, emphasising that even by 2071 the over 65s will contribute more financially than the entire government expenditure on NZ Super.

For many groups of older people, such as those employed in manual occupations (eg farming and construction); single women with minimal incomes and/or savings; Māori and Pacifica with worse health status and life expectations; those who pre-retirement are carers for parents and/or for the wider whanau; as well as those living with disabilities, the availability of NZS at age 65 can deliver a greater ability to live with some dignity in retirement.

Raising the age of eligibility for NZS will potentially remove some of the more physically and mentally capable individuals from contributing towards essential community volunteer work.

Volunteering NZ 6 have reported that the value of formal volunteering is over $4 billion per annum, with the highest participation in voluntary work being in the 65-74 age group, with participation dropping significantly for those aged over 75. The GPF survey of over 2800 members currently receiving NZS/Veteran’s Pension showed that 38% volunteered each week, with over 50% of these contributing more than 4 hrs per week.

For those dependent on NZS as their sole or dominant income in retirement relativity should be maintained to the nett average wage, to avoid the eroding of year on year value.

The current legislation sets the benchmark at after tax NZS for a couple to be no less than 66% and no more than 72% of the after-tax average wage. Treasury have forecast that pegging NZS increases to CPI increases alone would create significant long-term savings on NZS expenditure going forward.7 However this would have the greatest impact on the most vulnerable retirees as the value of NZS is forecast to fall from 66% of the after tax average wage to less than 50% in the 2050’s if implemented from 2025.

Treasury acknowledge that reducing the value of NZS will have significant impact on many of our more vulnerable retirees: -

“Older people are often carers, and often volunteer their time, provide community leadership, and facilitate the transmission of culture. This is especially significant for some population groups (e.g. Māori, Pacific and Asian communities). Their ability to do these things is likely closely linked to the income support provided by NZS and is therefore likely to be affected by changes to it.” 7

“..this approach [adjustments limited to CPI increases] would be likely to undermine the effectiveness of the present system at preventing poverty in old age and enabling older New Zealanders to share in increases in national income which their labour and investment have helped to create.” 7

The United Nations Independent Expert on the Enjoyment of All Human Rights by Older Persons, Rosa Kornfeld-Matte, reported some key insights on the adequacy of the current level of NZS in NZ.

“Old-age poverty is below the Organization for Economic Cooperation and Development (OECD) average. Nevertheless, as the basic pension remains very close to the poverty threshold and house prices rise, there are still concerns about poverty among older persons. A large group of older persons, around 60 per cent of singles and 40 per cent of couples, have little or no additional income apart from the New Zealand Superannuation, which makes them very vulnerable to any changes in policy or economic circumstances.

Moreover, the Superannuation is based on the assumption of mortgage-free homeownership for older persons. As private rental housing is becoming unaffordable under this regime and in view of the ongoing changes of tenure patterns, the number of older persons facing material hardship will increase and many of them will be in rental accommodation. The homeownership rate for older Māori in 2018 was 48 per cent, compared to 58 per cent of older persons of European descent. There is also considerable variation by age group, with a much higher poverty rate for persons aged 75 or more. There are also important disparities for older persons living in rural areas, including higher levels of poverty.” 8

GPF strongly supports maintaining the existing formula for calculating annual adjustments to NZS, especially as the current payment levels are close to the poverty level and any move to rely on CPI adjustments only would compromise the most vulnerable who have few options to improve their financial situation in retirement.

The NZS scheme is simple to administer, unlike systems with means testing such as in Australia. The bureaucracy involved with applying for and ongoing reporting requirements for Australian Pension recipients is inefficient and stressful for those entitled to a pension, while the administration charges are higher than for NZS as a universal benefit.

NZS does not distort incentives for employment and savings as much as means-tested systems. This was clearly evident when a NZS surtax was introduced from 1985 to 1998, when people went to great lengths to avoid paying it by hiding their assets in trusts etc.

Kaspanz editor Alec Waugh addressed the inefficiencies and unfairness of means testing in an article posted in July 2020.

One of the great strengths of universal benefits is that it is simple and economical to administer and operate. The opposite is true of means testing.

What means testing generally means is a lot more bureaucracy. This is quite likely to eat up any apparent savings that it is suggested it will make possible….. In summary the administrative mechanism for measuring need, is costly and difficult

We also know New Zealand remains full of trusts and asset protection schemes. These are designed to camouflage income, and for means testing to be at effective, all such protection schemes must disappear so all income earned is transparent. This is highly unlikely to occur.

Means tested benefits aren’t actually fair. It has long been known that large numbers of needy people tend to miss out on such benefits. Either they don’t know about them, they don’t realize they are eligible for them, or perhaps, particularly important, they are reluctant to claim them.

This is because they have increasingly been encouraged to think of receiving benefits as meaning being dependent and “not standing on their own two feet”. This is especially well known about older people and can result in them encountering health and other problems from under-claiming, which ultimately increases costs, as well as failing to ensure their access to entitlements.

When benefits have been universal, people have paid for them in their taxes. To change them into means tested benefits is quite simply a fraud, denying people entitlements they have contributed to and earned.” 9

While those retiring with significant savings and a lifetime of full employment and a mortgage-free home are able to enjoy a level of enjoyment and comfort in their retirement, this is not the case for a significant and growing proportion of retirees.

Recent media reports have highlighted case studies where retirees are cutting back on food and energy usage to survive – particularly the growing number that are renting. (Cost of living: Pensioners living in pain, skipping meals as inflation pushes essentials out of reach, Newshub 8 April 2023; TVNZ1 Sunday Program 23 April 2023; https://www.tvnz.co.nz/shows/sunday/clips/not-so-golden-years )

Those most affected, particularly during periods of high inflation are those with minimal financial reserves in retirement - women with a history of intermittent employment and low savings; those without a mortgage free home; those in rental accommodation; those with disability or poor health; those who have encountered a relationship breakup, those made redundant prior to retirement when re-employment is challenging, as well as many Māori & Pacifica people.

Securing adequate support for the more vulnerable retirees is not always easy and many older people are reluctant to ask, or to persevere with WINZ, to secure the help they are entitled to receive.

The adequacy of the NZS single living alone rate, equivalent to only 64% of the minimum wage, could be strongly contested. Many seniors who are dependent on NZS as their sole, or dominant income, are living in poverty unable to afford needed medical care, energy costs, transport & even food as they face increasing rent, and inflationary cost increases. The current level of NZS as sole income for retirees is insufficient to enable a significant proportion of retired people to have the economic freedom to be active participants in society in line with the Government’s “Better Later Life 2019-34” objectives.

With food inflation at 12.5% annually as of the end of April 2023, those on fixed incomes are having to do without. (https://tradingeconomics.com/new-zealand/food-inflation )

Utilising the Immigration Department’s Cost of Living in NZ calculator ( https://www.live-work.immigration.govt.nz/live-in-new-zealand/money-tax/cost-of-living-in-new-zealand ) indicates that for a single person on a living alone NZS payment, living in a rural city, and not paying KiwiSaver, would have net income of $488.21/week, but expenses of $1078.40/week if they had average expenses!

Over 40% of those over 65 have virtually no income besides NZS, and another 20% have only a little more. (Review of Retirement Income Policies 2022, Retirement Commission).

A survey of close to 3000 Grey Power members in June 2022 (GPF Survey 2022) revealed that 51% had cash reserves of less than $50,000 to access in their remaining retirement years.

For those with cash reserves, over 75% are drawing down up to $20,000 per year to manage their retirement living costs. Little wonder that 44% of respondents were worried about their likely financial situation in 10 years’ time, if the average reserve is less than $50,000.

The latest research on retirement oncome preferences shows a 15% increase since 2014 in those who were either “Not confident”, or “Not too confident” that they will be comfortable in retirement. 50% of the 1299 respondents aged 18+ are no longer confident that they will be comfortable in retirement! (Continuity and change: Retirement income preferences in New Zealand, 2014 – 2022. Andrew Coleman et al March 2023)

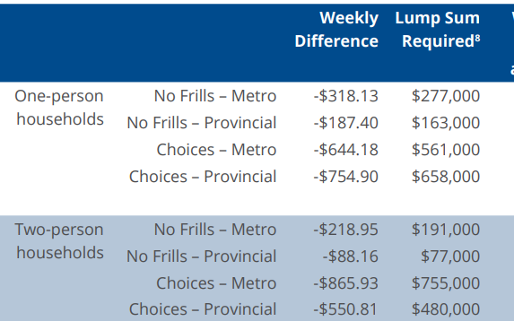

The 2022 Massey University New Zealand Retirement Income Expenditure report calculated the savings required for a retiree to supplement NZS to live either a “no-frills” or a “choices” lifestyle with NZS current settings. (See chart below for savings required to fund the difference between household expenditure and NZS payments. (Table 4, Page 9 NZ Retirement Income Expenditure Report.)

“The No Frills guidelines reflect a basic standard of living that includes few, if any, luxuries. The Choices guidelines represent a more comfortable standard of living, which includes some luxuries or treats.

The No Frills Guidelines are based on the average expenditure of the second quintile of the HES for retired households, while the Choices Guidelines are based on the average expenditure of the fourth quintile of the HES for retired households.”

The Accommodation Supplement maximum rates have not changed since April 2018 (www.WorkandIncome.govt.nz ), yet from April 2018 to January 2023 the median rent across NZ has increased by $150/week from $425 to $575. In addition, the cash asset level for eligibility for an accommodation supplement has been pegged at $8,100 for a single person and $16,200 for a couple for many years. For an independent retiree with a small car to maintain independence, $8100 is a stressfully small cash reserve to have for emergencies such as unexpected vehicle expenses or even replacement of the vehicle. Many also like to have some money saved and earmarked for their funeral, so drawing down their assets to under $8100 to become eligible for an accommodation supplement is not an easy option – especially for those in the 80’s living alone.

In contrast, those qualifying for public/social housing are allowed up to $42,700 in cash assets. (WINZ website). Also those on NZS in social housing will only pay rent equivalent to 25% of their weekly after-tax income. There is no such ceiling for those renting privately or residing in pensioner villages run by Councils or Service Clubs such as RSA.

GPF was disappointed to note that while maintaining the Winter Energy Payment, there was no provision made for a CPI increase in 2022 or 2023. This was a missed opportunity, especially as a large % of retirees are on low-tariff plans that are escalating in price over the next few years.

For those dependent on NZS as their major income, the Winter Energy Supplement has been a much-appreciated boost, allowing many to maintain their homes at a healthier temperature during winter. The GPF survey showed that for the 26.5% of members struggling to pay their living expenses on NZS, their greatest concern was meeting energy payments – identified by 68% of respondents. For this reason, GPF would support the continuance of the Winter Energy Payment, but with it indexed by the CPI each year.

The United Nations Independent Expert on the Enjoyment of All Human Rights by Older Persons, Rosa Kornfeld-Matte, reported some key insights on the adequacy of the current level of NZS in NZ.

“Old-age poverty is below the Organization for Economic Cooperation and Development (OECD) average. Nevertheless, as the basic pension remains very close to the poverty threshold and house prices rise, there are still concerns about poverty among older persons. A large group of older persons, around 60 per cent of singles and 40 per cent of couples, have little or no additional income apart from the New Zealand Superannuation, which makes them very vulnerable to any changes in policy or economic circumstances.

Moreover, the Superannuation is based on the assumption of mortgage-free homeownership for older persons. As private rental housing is becoming unaffordable under this regime and in view of the ongoing changes of tenure patterns, the number of older persons facing material hardship will increase and many of them will be in rental accommodation. The homeownership rate for older Māori in 2018 was 48 per cent, compared to 58 per cent of older persons of European descent. There is also considerable variation by age group, with a much higher poverty rate for persons aged 75 or more. There are also important disparities for older persons living in rural areas, including higher levels of poverty.”

(Visit to New Zealand : Report of the Independent Expert on the Enjoyment of All Human Rights by Older Persons; Kornfeld-Matte, Rosa; United Nations Digital Library https://digitallibrary.un.org/record/3875126?ln=en )

The Purpose Statement for New Zealand’s Retirement Income System, developed by an Expert Advisory Group to the Commission for Financial Capability (CFFC) encapsulates the key objective of our NZS and associated support for older people:

“A stable retirement income framework enables trust and confidence that older New Zealand residents can live with dignity and mana, participate in and contribute to society, and enjoy a high level of belonging and connection to their whānau, community and country.”

Due to the relatively low level of savings in Kiwisaver to date, the requirement for compulsory participation of all employees, as well as provision for the self employed and beneficiaries should be revisited to improve financial resilience across the whole population.

The average KiwiSaver balance for over 65 year olds, despite rising over the past 4 years, was $48,700 in the year to April 2022. This is way below the Massey University Retirement Expenditure Guidelines that recommends a one-person household has reserves of $600,000 to live in a metropolitan city and to have choices in retirement - $688,000 in provincial areas! “Even those expecting to live a no-frills lifestyle in the provinces would require a lumpsum equivalent to $170,000.” 11

In the GPF membership survey 67% of the 2180 members providing financial information had reserves (excluding their home) of less than $100,000 to draw upon in their retirement. Despite this 75% of those surveyed are supplementing NZS by up to $30,000 annually from savings, investments and part-time work. Clearly reserves are not going to last for many years and increasing numbers of retirees will require supplementary benefits or a significantly higher rate of NZS. Even today 18% of our members on NZS are living close to the poverty line with no ability to supplement their NZS at all.

GPF supports the value of KiwiSaver to better prepare future New Zealander generations to be more financially resilient. However, the amounts accumulated to date are significantly below what is required, and the ability to “opt out” means that the scheme is not as effective as it could be. We would encourage a review of how KiwiSaver could provide greater retirement support going forward, with potential compulsory participation and a small increase in the employer and employee contribution rates gradually phased in as average wages in NZ begin to increase.

References